Robotic Process Automation or RPA is a popular concept among all industries and the BFSI sector is not an exception! As a robust technology useful for automating repetitive manual business processes, RPA has gained ground swiftly across different sectors. Talking about banking and finance, increasing business scopes and rising number of online transactions have made this sector highly promising yet challenging. These conditions have put tremendous pressure on the sector to adopt robotic technology. In this article, we will discuss the role of RPA in banking industry.

The banking sector has witnessed a surge in handling cash and various processes including credit lines, loans, capital market transactions etc. in recent years. On one hand, this vertical increase has made the banking industry at the centre stage of industrial growth, and on the other hand, it has made bank employee’s life difficult. Here, RPA lends a helping hand by automating several processes like KYC, credit reports, underwriting, etc. Let’s understand some of the major applications of RPA in banking sector along with the challenges associated with its adoption.

Before moving ahead, let’s start by answering a basic question.

What is RPA in Banking?

As per the definition, RPA in banking is implementing emerging technology to automate several repetitive processes in banks and financial institutions. On one hand, RPA in banking can decrease human intervention significantly, and on the other hand, it enables banks to maintain high efficiency for grabbing new opportunities. RPA in banking sector is useful in processing payments, deposits, and other banking transactions without manual support or supervision. Banks can see a high ROI rapidly by integrating rule-based automated workflows. RPA can save a lot of time and energy for bank employees while ensuring high efficiency and productivity.

RPA in banking can promote digital banking including mobile payments and crypto transactions. Banks can automate mundane tasks like data entry and customer services with the help of RPA or software bots. RPA ensures 24x7 services and bank customers can get assistance anytime with the help of bank bots. As RPA development companies can integrate advancements of AI and ML in the bots, banks can provide their customers with better and more personalized services in the future.

RPA Use Cases in Banking

RPA in banking and finance can augment or replace human efforts with the help of robotic applications. The BFSI sector can utilize RPA in commercial banking, wealth management, capital markets, and retail banking. Here, automation is limited to rule-based, repetitive processes across different departments. Before looking at the key benefits of RPA in banking industry, let’s go through its major use cases.

Loan Processing

As per the traditional model, a specific number of employees is kept for loan processing. It made the entire process long and cumbersome for customers. Today, RPA in banking saved time in loan processing and brings real value through automation. RPA software can consolidate the relevant information from paper-based documents of prospective customers, third-party systems, and various service providers. As a result, it becomes easier for the bank to approve and process the loan as per their predefined standards.

Customer Services

Success and expansion the banking institutions largely depend on customer satisfaction. How quickly banks can resolve the customer’s queries and respond to the suggestion can determine the level of customer services. Thanks to RPA, automation of such services becomes possible. Customers can check account balances, mortgage application status, loan process updates, and initiate chequebook requests using the robotic software. RPA decreases the customer service response time while eliminating the need for human intervention.

Accounts Payable

RPA solutions can play a vital role in managing the process related to accounts payable. Usually, many invoices are still in paper form without any uniformity or standardization. As a result, banking employees have to manage this monotonous and time-consuming process by doing a lot of copy-pasting. RPA in banking sector can easily automate rule-based processes including retrieving the vendor’s data, initiating online payment, and checking for mistakes in any invoice. Customized RPA software with OCR (Optical Character Recognition) can capture and reenter the data automatically while providing an audit trail for annual auditing.

Fraud Detection

Banks remain the soft target for hackers to get highly sensitive information of clients. An official study has revealed that skilled professionals waste around 75% of their productive time collecting data to uncover the instances of fraud. RPA-powered fraud detection systems and ML-based anomaly detection systems can easily find any suspicious activities or transactions to protect your customers from any online fraud. RPA in banking industry is useful in monitoring transactions on a 24x7 basis and detecting anomalies in them. It also minimizes the need for humans for finding fraudulent transactions and data manipulations.

KYC

KYC or Know Your Customers is the backbone of the banking system. It should be in line with the ever-changing regulations and stringent rules of scrutiny. RPA can bring automation to the KYC process while making it quicker, safer, and more accurate. You can seamlessly integrate the RPA in the banking system to collect, validate, store, and compile the customer’s data. It can save a lot of time and effort for your customers and employees alike. In the coming years, we will see that almost all banks will jump into the KYC automation bandwagon because of these benefits.

Other use cases include the processing of credit cards, accounts closure, and compliance maintenance. The RPA technology evolves and combines with other emerging technologies like AI and IoT, more banking services will start gaining the advantage of RPA solutions.

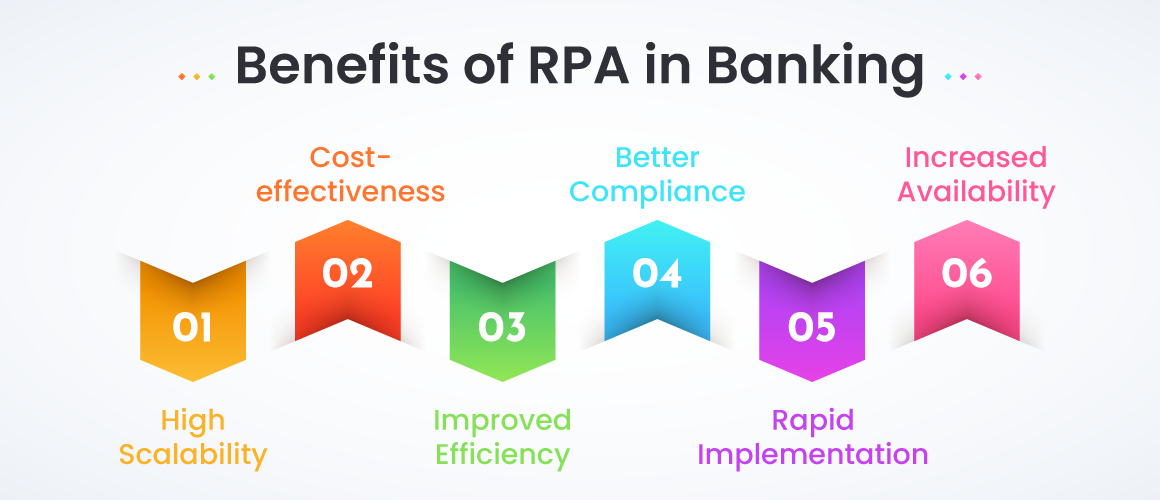

Benefits of RPA in Banking

RPA has many benefits to offer in the banking and financial services industry. However, here, we will mention some of the noteworthy benefits.

High Scalability

It is fair to mention that software bots are highly scalable and manage big volumes of data even during peak hours. More bots can facilitate banks to respond to any scenario in a quick and effective way. What’s more, RPA enables banks to give more attention to innovative ideas. As employees can get rid of time-consuming and monotonous activities with RPA solutions, they remain more efficient and productive. The high scalability of RPA solutions is useful in grabbing new business opportunities for banks and opening the doors of expansion.

Cost-effectiveness

As mentioned above, RPA solutions can bring automation in repetitive processes and assist the banking sector in cost-cutting. A dedicated banking RPA software reduces both time and cost by up to 50 per cent. Reduced operational costs and increased efficiency can lead to high ROI in a relatively short time of implementing RPA in banking sector. Banks can easily streamline and manage their workflows without hiring additional people for this task.

Improved Efficiency

The BFSI sector has witnessed a huge surge in loan requests, credit card requests, and other areas of services in recent years. In such a scenario, the sector must increase operational efficiency. A customized RPA solution can make banks more productive by increasing operational efficiency. Banks can save time and increase revenue by improving efficiency in multiple processes.

Better Compliance

Banking is a highly regulated sector. Every bank or financial institution has to follow all the prevalent laws and standards to continue its services. Robotic process automation can enable banks to manage risks and follow standards by cheating comprehensive audit trails. It means that banks can get audit trails for all major activities. Real-time reporting and data access using the advancements of emerging technologies can ensure high compliance and seamless workflows.

Rapid Implementation

A tailored RPA solution can automate various banking procedures after having a successful and quick implementation. Banks can establish and run automated workflows through different tools and methods. Training of employees is also easy and does not take much time in learning the drag-and-drop method for different procedures. Also, RPA is highly flexible and reduces hardware and maintenance costs significantly by using cloud technology.

Increased Availability

Software bots are available 24x7x365, and when it comes to reducing human errors or achieving high accuracy without spending a small fortune. As a result, many banks can strengthen their global footprints and remain more competent than before. Continuous availability of data can also increase trust among your customers and you can eventually get a huge customer base consisting of loyal customers that can take your bank to a new level.

You May Also Like: Top Business Benefits of Robotic Process Automation You can consider In 2023

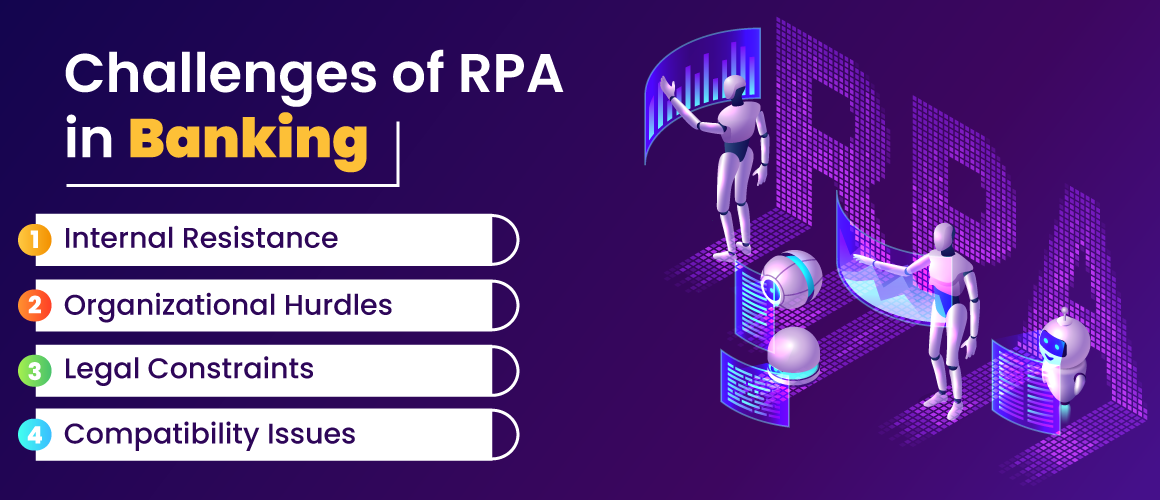

Challenges of Robotic Process Automation in Banking

Though robotic process automation can be a game-changer for the banking sector, it is necessary to address several challenges to leverage its benefits. Here we mention these major challenges-

Internal Resistance

A custom RPA solution aims at reducing human effort and not reducing the number of employees. However, many bank employees are not ready to accept this fact. They resist change and automation when you try to implement RPA software in the banking industry.

Organizational Hurdles

As per the Robotics and Cognitive Automation Report of Deloitte, process standardization and organizational misalignment are a few of the top challenges of RPA implementation in banking. It is necessary to set up a new distribution of roles and responsibilities to avoid such organizational hurdles.

Legal Constraints

Process automation requires meeting legal regulations while addressing different constraints. Though RPA is around us since the year 2000, it entered the market in 2015. Therefore, this technology needs proper legal regulations when it comes to implementing its banking and finance institutions.

Compatibility Issues

Slow pace of technological advancement in the banking sector is one of the most common hurdles to RPA adoption. Though this sector is driven by data, it lacks digital transformation, and therefore, most institutions still rely on legacy infrastructure. Reuters has reported that almost 43 per cent of banks in the USA still use COBOL, a programming language developed back in the late 1950s. This situation creates compatibility issues while implementing RPA in the banking industry.

How to Implement Robotic Process Automation in Banking

Developers need to consider the following aspects while implementing RPA solutions in banks and financial institutions.

- Define the problem that you want to solve using RPA software

- Find out processes that you can automate

- Assess the feasibility of automation in the bank

- Select the right RPA tool to meet the bank’s needs

- Train their staff for using the RPA software

- Keep the RPA solution in a trial period for a while and evaluate the results of this period

- Make the necessary changes based on the feedback of the client

- Expand the use of RPA across different departments including auditing, loan processing, and KYC

Though we have covered many major aspects here, it is better to consult a reputed RPA solution development company to get more tips to ensure the success of RPA implementation in banks.

Why Silver Touch for RPA

Silver Touch is your one-stop destination for all RPA services. Our experienced RPA developers assist you to explore various possibilities with customized, advanced solutions.

Here are some of the key reasons why enterprises across the world prefer us as a trusted RPA solution provider-

- Expertise in training with excellent technical assistance

- Automation consulting and feasibility analysis from certified RPA experts

- Bot development with the highest accuracy and efficiency

- Digital transformation advantage

- All enterprise software services under one roof

- Dedicated ODC (Offshore Development Center) for all your outsourcing requirements

With over 1400 experienced IT professionals we have served a global corporate clientele across different industry sectors.

Concluding Lines

Banks can automate mundane processes, improve the customer experience, increase efficiency, and reduce operational costs with the help of RPA technology. RPA in banking industry aims at bringing automation for making daily operations more efficient and customer-friendly. All you need to find the right robotic process automation solutions provider to leverage the benefits of RPA in banking.

FAQs About RPA in Banking

What is RPA and how does it work in the banking industry?

RPA is an emerging technology that brings automation to repetitive processes with the help of software bots. It can streamline the workflow of the banking system, improve efficiency, increase scalability, and assist banks to deal with fraudulent transactions.

How can RPA improve efficiency in the banking industry?

Custom RPA solutions can automate repetitive processes including data entry and auditing. This automation can make bankers free to focus on other productive activities and make them more efficient.

What are the benefits of implementing RPA in the banking industry?

Implementing RPA can save operational costs, improve efficiency, increase collaboration, and enhance compliance in the banking industry.

What are the challenges of implementing RPA in the banking industry?

Top challenges of implementing RPA in the banking industry are legal constraints, compatibility issues, and internal resistance.

Are there any notable examples of RPA implementation in the banking industry?

Customer support software bots and KYC software are noteworthy examples of RPA in the thriving banking sector.